Wyoming Early Stage Investment Report 2019-2023

- peter74956

- Jul 19, 2024

- 4 min read

Wyoming's environment for angel and venture capital investing is relatively nascent compared to more established hubs like California or New York. However, the state has shown some promising trends and attributes that could make it an increasingly attractive destination for investors. The data included in this report comes from PitchBook and CrunchBase and covers the dates of 1-1-2019 through 12-31-2023. Seed stage data is specifically selected including the categories of Seed, Angel (Individual), Accelerator/Incubator, and Equity Crowdfunding.

Here are some key points about Wyoming's investment landscape:

Ranking Within the United States: Wyoming typically ranks lower in terms of overall venture capital activity compared to larger states with established tech ecosystems. However, its ranking may vary depending on specific metrics such as business friendliness or economic outlook.

Number and Type of Investments: Wyoming tends to see fewer investments compared to major hubs. However, there has been a notable increase in angel and venture capital activity in recent years, particularly in sectors such as outdoor recreation, tourism, energy, and agriculture. Additionally, there's a growing interest in supporting startups focused on sustainability and technology-driven solutions.

Size of Investments: While individual investment sizes in Wyoming may not reach the levels seen in more mature markets, there has been a noticeable uptick in the amount of capital flowing into the state. This includes not only traditional venture capital but also angel investments, grants, and other forms of funding.

Positive Trends: Despite its relatively small size and population, Wyoming offers several advantages that could attract investors. These include a business-friendly regulatory environment, low taxes, access to natural resources, and a burgeoning entrepreneurial ecosystem. Additionally, the state's focus on diversifying its economy beyond traditional industries like energy and agriculture bodes well for the future of startups and innovation.

More Startups Created: Wyoming has seen an increase in the number of startups and entrepreneurial ventures in recent years. This growth can be attributed to various factors, including support from local government initiatives, the presence of incubators and accelerators, and a growing network of angel investors and venture capitalists interested in the state's potential.

Exits and Success Stories: While Wyoming may not have as many high-profile exits or success stories as some other states, there have been notable examples of startups achieving significant milestones, attracting acquisition offers, or going public. These success stories help validate Wyoming's growing reputation as a viable destination for entrepreneurial ventures.

Overall, while Wyoming's angel and venture capital ecosystem may still be in its early stages compared to more established hubs, the state shows promising signs of growth and potential. With continued support from government, investors, and the entrepreneurial community, Wyoming could become an increasingly attractive destination for startup investment in the coming years.

When ranked in terms of venture capital investment per GDP Wyoming ranks fourth in the country behind California, Massachusetts and Delaware. US News & World Report evaluates the amount of venture capital dollars invested in each state, relative to $1,000 of the state’s nominal gross domestic product. Statista ranks Wyoming at #29 based on total investment at $660 million in 2022. Wyoming continues to climb up the ranks.

Investment Trends

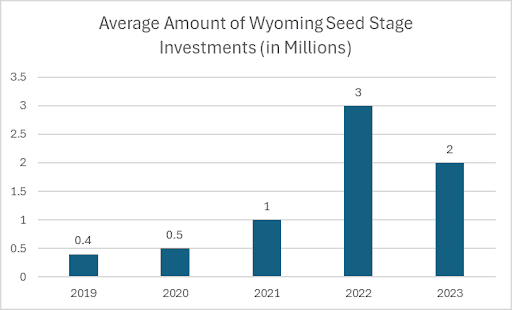

Wyoming followed national trends in the U.S. with increasing investments during the years leading up to 2022, growing by over 500% from 2019 to 2023. The dropoff in investment in 2023 was about 36% which represents a significant decrease, but is on par with the steep decline seen across the U.S. in 2023 in all states.. This decline is largely due to the rapid increase in interest rates and the accompanying decrease of venture capital allocation worldwide that occurred beginning in the second half of 2022 and continuing through today.

While Wyoming’s investment dollars decreased in 2023, the deal count increased. This indicates an increase in smaller deals which is supported by the next chart showing a decrease of nearly 50% in the average dollar amount invested in each deal.

Valuations and Deal Sizes Increase

Wyoming’s startups saw valuations increase significantly between 2019 and 2022. Same stage deals are being valued at more than 250% more than they were in 2019, growing from $4 million to $11 million.

Employment at Wyoming’s Seed Stage Companies

We took the total number of employees at companies who raised money in 2019 through 2023 and added them up. The result shows that total employment in Wyoming seed stage startups is increasing rapidly. This should come as no surprise since several research reports have shown startups to be the greatest single source of jobs in an economy.

Exit Activity

Wyoming also saw solid gains in exits during this period, both in the number of deals and in deal size. This trend also represents the national average. Exits decreased significantly in 2023.

Industry Representation

Deals of all types in Wyoming showed strength in Oil & Gas, Manufacturing, Cannabis, LOHAS & Wellness, Fintech and Crypto/Blockchain. Other industries represented include CleanTech, Mobile, SaaS, TMT, E-Commerce, Industrials, Climate Tech and HealthTech.

Agriculture, Mining and Tourism rank among Wyoming’s biggest industries, but were not well represented in venture capital investment.

Conclusions:

Wyoming’s seed stage investment decreased significantly in 2023 along with the rest of the country.

Deal count was up, however, indicating continued interest in Wyoming deals.

Employment in seed stage companies increased impressively by 19X over the five year period, highlighting the job creation power of Wyoming’s startups.

Most capital invested in Wyoming is coming from out of state.

Wyoming’s growth from 2019 to 2023 shows that the state can create investable and excitable startups and that investors and acquirers are willing to put money into them.

Appendix: Wyoming Deal Logo Cloud (including breakout by industry)

Comments